International Monetary Fund

|  |

Name: International Monetary Fund | |

| Acronym: IMF | |

| Year of foundation: 1944 | |

| Headquarters: Washington D.C., USA | |

| IMF documents: go to page | |

| Official web site: go to page |

Description

The International Monetary Fund (IMF) is a specialized agency of the United Nations. It has been established to foster international monetary consultation and co-operation with a view to maintaining global financial stability.

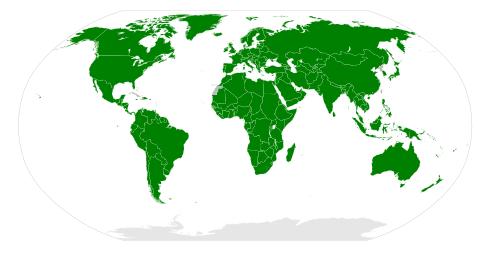

Member States

The IMF has 186 member States, namely: Afghanistan, Albania, Algeria, Angola, Antigua and Barbuda, Argentina, Armenia, Australia, Austria, Azerbaijan, Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Belgium, Belize, Benin, Bhutan, Bolivia, Bosnia and Herzegovina, Botswana, Brazil, Brunei Darussalam, Bulgaria, Burkina Faso, Burundi, Cambodia, Cameroon, Canada, Cape Verde, Central African Republic, Chad, Chile, China, Colombia, Comoros, Democratic Republic of the Congo, Republic of the Congo, Costa Rica, Côte d'Ivoire, Croatia, Cyprus, Czech Republic, Denmark, Djibouti, Dominica, Dominican Republic, Ecuador, Egypt, El Salvador, Equatorial Guinea, Eritrea, Estonia, Ethiopia, Fiji, Finland, France, Gabon, Gambia, Georgia, Germany, Ghana, Greece, Grenada, Guatemala, Guinea, Guinea-Bissau, Guyana, Haiti, Honduras, Hungary, Iceland, India, Indonesia, Iran, Iraq, Ireland, Israel, Italy, Jamaica, Japan, Jordan, Kazakhstan, Kenya, Kiribati, Korea, Kosovo, Kuwait, Kyrgyz Republic, Lao People's Democratic Republic, Latvia, Lebanon, Lesotho, Liberia, Libyan Arab Jamahiriya, Lithuania, Luxembourg, Macedonia, Madagascar, Malawi, Malaysia, Maldives, Mali, Malta, Marshall Islands, Mauritania, Mauritius, Mexico, Micronesia, Moldova, Mongolia, Montenegro, Morocco, Mozambique, Myanmar, Namibia, Nepal, Netherlands, New Zeland, Nicaragua, Niger, Nigeria, Norway, Oman, Pakistan, Palau, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russian Federation, Rwanda, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, Samoa, San Marino, São Tomé and Príncipe, Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Singapore, Slovak Republic, Slovenia, Solomon Islands, Somalia, South Africa, Spain, Sri Lanka, Sudan, Suriname, Swaziland, Sweden, Switzerland, Syrian Arab Republic, Tajikistan, Tanzania, Thailand, Timor-Leste, Togo, Tonga, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Uganda, Ukraine, United Arab Emirates, United Kingdom, United States, Uruguay, Uzbekistan, Vanuatu, Venezuela, Vietnam, Republic of Yemen, Zambia, Zimbabwe.

Brief History

Together with the International Bank for Reconstruction and Development (IBRD), the Fund originated form the Final Act adopted by the UN Monetary and Financial Conference held at Bretton Woods, New Hampshire (US), in July 1944 with the participation of representatives of 44 countries. According to the “division of labour” between the two institutions envisaged at Bretton Woods, the Fund’s activities were primarily intended to provide temporary balance of payments assistance while the IBRD was to be essentially concerned with long-term project and economic development finance.

The Articles of Agreements of the Fund were signed on 22 July 1944 and came into force on 27 December 1945 when 35 countries, whose quotas amounted to 80 per cent of the Fund’s resources, deposited their ratification of the Bretton Woods Agreements. The Fund began operations in Washington on 1 March 1947. The “original members” of the Fund include the countries participating in the Bretton Woods Conference which accepted the Articles of Agreement within a prescribed time limit; 39 out of 44 countries became “original members”, the then USSR being the only important exception. “Other members” are the countries which have subsequently joined the Fund under the terms and conditions set out in the Fund’s resolutions admitting them to membership.

Nowadays, the IMF’s inlfuence in the global economy steadily increased as it accumulated more members. The number of IMF member countries has more than quadrupled from the 44 states involved in its establishment, reflecting in particular the attainment of political independence by many developing countries and more recently the collapse of the Soviet bloc. The expansion of the IMF’s membership, together with the changes in the world economy, have required the IMF to adapt in a variety of ways to continue serving its purposes effectively.

In 2008, faced with a shortfall in revenue, the International Monetary Fund’s executive board agreed to sell part of the IMF’s gold reserves. On 27 April 2008, IMF Managing Director Dominique Strauss-Kahn welcomed the board’s decision of 7 April 2008 to propose a new framework for the fund, designed to close a projected $400 million budget deficit over the next few years. The budget proposal includes sharp spending cuts of $100 million until 2011 that will include up to 380 staff dismissals.

IMF Structure and Decision-making Procedures

The Board of Governors

The Board of Governors is vested with all powers and consists of one governor and one alternate governor appointed by each member country. It holds an ordinary annual meeting - usually in September and in conjunction with that of the World Bank Group - to consider the Fund’s operations and set down the basic guidelines to be implemented by the Executive Directors, to whom the Board has delegated many of its powers; between annual meetings the governors may take votes by mail or other means. Certain fundamental powers cannot be delegated and remain the sole responsibility of the Board of Governors. They concern, inter alia, the admission or suspension of members, the adjustment of quotas, the distribution of the net income, the liquidation of the Fund, and the election of Executive Directors. In principle, the Board’s decisions are to be adopted by a majority of the votes cast, except as otherwise specifically provided. Each member has 250 basic votes, plus one additional vote for each part of its quota equivalent to 100.000 special drawing rights (SDR). SDRs were introduced in 1969 as an international reserve asset for allocation by the Fund in order to supplement the existing official reserves of member countries and thus improve the liquidity of the international monetary system. The SDR also serves as the unit of account of the Fund and some other international organizations. Voting rights in the Fund are proportionate to the amount of each member’s quota. As of October 2007, the US remained by far the largest shareholder in the Fund.

The Executive Directors

There are at present 24 Executive Directors, who permanently reside in Washington, DC, meet as often as required (usually several days a week) under the chairmanship of the Managing Director, and are responsible for the day-to-day operations under the powers delegated by the Board of Governors. Directors are appointed or elected by member countries or by groups of countries. Each one of the eight members with the largest quotas - the US, Japan, Germany, France, the UK, Russia, China and Saudi Arabia - appoints an Executive Director. The other 16 Directors are elected every two years by the Governors for the remaining member countries, grouped according to geographical and other criteria; each Director casts all the votes of the countries which contributed to his election. Since a member’s voting power depends on the size of its quota, quotas also have a bearing on the formation of the constituencies. However, in practice most decisions are taken on the basis of consensus rather then of formally cast votes.

The Managing Director

The Managing Director, elected by the Executive Directors for a five year term which may be extended, is ex officio Chairman of the Executive Directors and is assisted by a Deputy. He conducts the ordinary business of the Fund and is responsible for the organization, appointment and dismissal of the officers and staff. According to an established practice, the post of Managing Director of the Fund is reserved to a European citizen while a US citizen is appointed President of the IBRD.

An Interim Committee of the Board of Governors on the International Monetary System and a Joint Committee of the Board of Governors of the Fund and the World Bank on the Transfer of Real Resources to Developing Countries were established with advisory functions and held their initial meetings in January 1975. The Second Amendment to the Articles of Agreement empowers the Board of Governors to decide, by a large majority of the total Council, which would be similar to the Interim Committee as regards composition and terms of reference but would have decision-making power.

In 1999 the Interim Committee was transformed into the permanent International Monetary and Financial Committee (IMFC). The IMFC, consisting of 24 members representing the same countries of groups as those on the Board of Executive Directors, performs advisory functions but has no decision-making powers.